I bet I already know a lot about you…

- You work really hard to earn your money

- You work even harder to grow your business

- You dread tax time and might even be petrified by the IRS

- Paying money to the government is painful

- You secretly wonder if you have enough for your retirement

- You wish you had a bigger nest egg to travel more often, give to your children, pay down debt, or…

Am I close? If this describes you at all then I know for a fact that you’re hard working, you probably have a successful business… and you’re probably overpaying your taxes… by as much as $5,000 or even $50,000 a year!

The problem is, most entrepreneurs would rather spend their time building their business than protecting the money they earned…

… but I think: “why work so hard on building a bigger boat if you haven’t plugged all the holes?”

Look, building an amazing business is fun and rewarding… but KEEPING your hard-earned money is amazing, too, and it allows you to build an even better business.

Yet, why do most entrepreneurs miss this part and unwittingly pay so much in tax?

- I think it’s because they’re hardworking and creative so they prefer to work on their business

- Few people understand taxes (and fewer still understand entrepreneurial and start-up taxes) so there’s plenty of misunderstanding

- Finance and taxes seem boring

So many people are afraid to ask questions or admit they don’t know everything there is to know about money, taxes, retirement and investments.

But what if there was a way to instantly analyze your business and discover all of the ways that you can save thousands of dollars on taxes – AND do so in a pain-free, “non-boring” way! with the help of someone who actually UNDERSTANDS entrepreneurial taxation?

If you could save $100 a year, what would that be worth to your business in your lifetime?

If you could save $1,000 a year, what would that be worth to your business (and to you!) in your lifetime?

What if you could save even more?

Most entrepreneurs are overpaying up to $50,000 a year… what if you could save THAT amount???

I want to help you save hundreds or even thousands of dollars this year alone… which I’m confident will lead to hundreds of thousands or even millions of dollars in money in your pocket over the lifetime of your business.

To help you, I’ve created a simple list of questions to get you thinking…

- Do you know WITH CERTAINTY – that you are taking advantage of ALL applicable write offs?

- Do you know the difference between various business entities and how it affects how much you pay?

- Do you know if you are legally following all the ‘corporate’ rules?

- How many myths are there about taxes and your business that you are guilty of believing?

- Are you deducting your medical expenses through your business?

- Do you know all your retirement savings options?

Your tax is one area where ignorance is NOT bliss.

Knowledge is Power!

Take the power back from the IRS by keeping more money in your pocket now and to the future. Save hundreds or even thousands of dollars this year… and accumulate hundreds of thousands or even millions of dollars in your pocket over the lifetime of your business.

[raw_html_snippet id=”whitebox”]

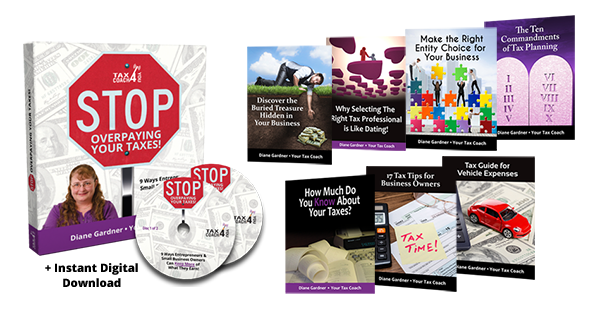

I reveal all of this information in my Tax Saving Bundle!

[raw_html_snippet id=”close”]