In the past blog post, which you can find here, we walked through how to use the Profit First Instant Assessment to gauge where your business is financially right now to help see how much profit your business should be making.

Now we’re going to figure out what you should be aiming for in terms of profit and the rest of the allocations. Since each business is unique and each industry is different you’re going to have to do a bit of research to understand the benchmarks you should be aiming for with your particular business.

But before we jump in let’s talk about two of the most common mistakes business owners make when starting with the Profit First system.

Number one is over-analyzing the numbers. Just like the Instant Assessment is a rough sketch of your financial situation, not a perfect depiction, I don’t want you to get bogged down in the details of your Target Allocation Percentages and never take action. If you feel like you’re lost in the research or you spend more than a few hours trying to find the exact percentages for your industry, don’t worry about it. Use what information you’ve got and move on.

The second is setting your sights too high, too fast. Aiming for a profit percentage of 20% is fine, but starting off that high might be like throwing 315 lbs on your bench press when you haven’t been to the gym in months. You’re going to want to aim high but start small and scale up.

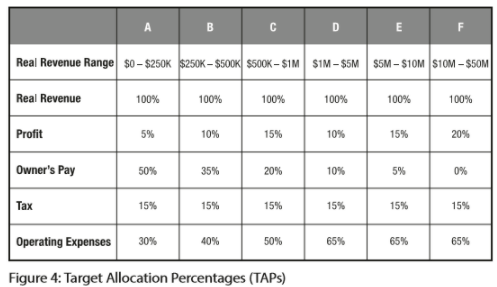

Setting Your Target Allocation Percentages (TAPs)

To figure out your TAPs you will need to do a little research, there are a few ways to go about doing this.

- Start with public companies in your industry. Do a search for “financial market overview” and you will find a number of websites that report on public company financial info. Look up at least five companies in your industry, or if you can’t find your niche, expand. Look up the income statements for the last five years then divide the net income (profit) number by the total sales/revenue number. Do this for each year and you’ll get the average profit percentage for that company, average the averages from the five companies and you will have a solid idea as to the average profit percentage for the industry as a whole.

- Look at your tax returns for the last three to five years, assuming your business has been running that long, and look at the profit percentages for your most profitable year. The percentages are important because a billion dollar company with a million dollars in profit is in big trouble, whereas a five million dollar company with a million dollars in profit is doing fantastic.

- The easiest way is to pick your profit percentage number based on the projected revenue from your Instant Assessment. Here it is for reference.

In the end, we’re aiming to get your business up to 20% profitability as quickly as we can. Not only does having a higher profit percentage mean more money in your pocket as the owner and no longer living on the leftover scraps of your business (which is why you started it in the first place, right?), but it also protects your business in the case of a sudden downturn.

Here are some good rules of thumb for longevity in your business based on your profit allocation:

- 5% profit allocation = 3 weeks of operating cash

- 12% profit allocation = 2 months of operating cash

- 24% profit allocation = 5 months of operating cash

As your profit percentages double, longevity nearly triples because that means your business is more efficient and operating expenses are lower.

So let’s get your profit allocation to 20% as quickly as we can, because it’s a big win/win for your business no matter how you slice it.